Building a mobile payment system requires more than technical prowess – it demands a profound understanding of the customer discovery process and the intricacies of software development. Crafting a seamless user experience for mobile payments is a goal and a necessity for success. However, achieving this requires a strategic approach that harmonizes the intricacies of payment technologies with a user-centric design philosophy.

At Aloa, a leading software outsourcing authority, we are your committed partners in creating your mobile payment system. Our seasoned professionals bring unparalleled expertise to guide your business startup through the intricate mobile payment system development process. With a proven track record of successful collaborations, Aloa offers a streamlined approach that saves time and resources and ensures the realization of your vision.

In this blog, we will navigate the dynamic landscape of mobile payment system development, unraveling the essential steps, key features, and numerous benefits to guide you in crafting a robust and tailored solution for your business.

Let's dive in!

Development Process of Building a Mobile Payment System

Developing a mobile payment system requires meticulous planning and execution. In this exploration, we'll unravel the essential steps guiding you through the intricacies of seamlessly incorporating robust features, ensuring a user-centric and efficient solution for your mobile payments.

Step 1: Customer Discovery Process

In mobile transactions, understanding user behavior is pivotal. The Customer Discovery Process serves as a lens, allowing developers to decode the nuanced landscape of payment preferences. By scrutinizing user interactions with digital transactions, developers discern crucial functionalities for a seamless payment experience. This process enables businesses to create a narrative aligning with user expectations, delving beyond demographics to address motivations and pain points.

Here are the ways to conduct a Customer Discovery:

- Market Research: Identify target demographics and preferences through comprehensive market analysis.

- User Insights: Utilize surveys and interviews to gather insights from potential users.

- Competitor Analysis: Analyze existing mobile payment systems, including Apple Pay, Google Pay, Samsung Pay and WeChat Pay, to comprehensively grasp user expectations and identify potential pain points.

- Trend Exploration: Explore emerging trends in mobile transactions to anticipate evolving user needs.

- User Personas: Develop user personas to create a comprehensive profile of target users.

Steps 2:Conceptualization and planning

In mobile payment system development, conceptualization and planning lay the groundwork for success by orchestrating a strategic approach that considers various factors essential for effective implementation and achieving project objectives.

Key points:

- Define Clear Vision and Goals: Clearly articulate the purpose and objectives of the mobile wallet app, establishing measurable goals to guide development and assess success.

- User-Centric Feature Definition: Identify features based on customer feedback and market research, prioritizing those that address user needs and pain points.

- Project Planning: Create a detailed project plan with timelines, tasks, and milestones, allocating resources effectively to consider human and technological needs.

- Technology Stack Selection: Choose a suitable technology stack for both backend and digital development, ensuring compatibility, scalability, and ease of maintenance.

- Security and Compliance Considerations: Outline security measures to protect user data during transactions, ensuring compliance with industry regulations and standards to prioritize user trust and data integrity.

These fundamental elements form the foundation of a robust mobile payment system. This phase sets the stage for a seamless and secure development process, aligning with user expectations and industry standards.

Steps 3: Prototyping and Design

The Prototyping and Design phase is pivotal in shaping the mobile payment system into a tangible, user-centric solution. Here, prototypes and wireframes are meticulously developed to visually represent the planned user interface and system flow. This process is akin to sketching the blueprint, offering stakeholders a tangible preview of the mobile payment system.

The iterative nature of this stage is crucial. Initial prototypes are constructed based on defined requirements, providing a dynamic visual representation of user interactions. Continuous refinement follows, driven by valuable user feedback, ensuring design elements evolve to meet the criteria of intuitiveness and user-friendliness.

Beyond aesthetics, the focus is crafting an interface that seamlessly aligns with user behaviors, fostering a natural and engaging experience within the digital payment realm.

Steps 4: Software Development:

Software Development is a phase where abstract plans crystallize into a functional reality within your mobile payment system. This stage is the heartbeat of turning envisioned features into tangible components, orchestrating a seamless and secure payment experience for users.

Key Points:

- Implementing Functional Components: Develop backend and frontend components focusing on robust security measures.

- Agile Development Methodologies: Utilize agile methodologies for flexibility and responsiveness to changing requirements.

- Integrating Payment Gateways: Integrate secure and reliable payment gateways for seamless transactions.

- Thorough Testing Protocols: Rigorously test payment processing to meet industry standards and ensure a secure financial environment.

- Collaborative Development Environment: Establish a collaborative development environment, fostering communication and efficiency among team members.

As the software development phase unfolds, meticulous attention to the key points ensures a robust foundation for the mobile payment system. By adhering to these principles, the development process can yield a seamless, efficient, and secure solution that meets user needs and industry standards.

Step 5: Integration of Payment Gateways

The fifth step in developing a mobile payment system involves seamlessly integrating gateways. This critical phase ensures the system can securely and efficiently facilitate financial transactions, providing users with diverse and reliable payment options.

Key Points:

- Choose and Integrate Payment Gateways: Select reputable payment gateways like PayPal or Stripe and seamlessly integrate them into the mobile payment system. This step is crucial for providing users with various trusted payment options.

- Implement Secure Payment Processing: Ensure the implementation of robust security measures during payment processing. This includes encryption and compliance with industry standards to safeguard sensitive user data and financial information.

- Ensure Compliance with Regulations: Adhere to industry regulations and standards to prioritize legal compliance. This fosters user trust and ensures the integrity and legality of financial transactions within the system.

- User-Friendly Payment Mechanisms: Develop intuitive and user-friendly payment mechanisms within the mobile app. This optimization aims to enhance the overall user experience and encourage seamless transactions.

- Thorough Testing for Reliability: Conduct comprehensive testing of the integrated payment gateways to guarantee reliability. This involves identifying and addressing potential issues before deploying the system, ensuring smooth and error-free transaction processes.

Incorporating payment gateways seamlessly into the mobile payment system is a pivotal step. This ensures that users have a secure and diverse array of payment options, contributing to a positive user experience and fostering trust in the reliability and security of the financial transactions facilitated by the system.

Step 6: Testing and Quality Assurance

The penultimate step in developing a mobile payment system is dedicated to thorough testing and quality assurance. This crucial phase ensures the system functions seamlessly, meets user expectations, and adheres to stringent quality standards.

Key Points:

- Functional Testing: Conduct rigorous functional testing to verify that all components of the mobile payment system work as intended. This includes testing individual features, transaction processes, and overall system functionality.

- Security Testing: Prioritize security testing to identify and address vulnerabilities in the system. This step is essential to safeguard user data, financial transactions, and overall system integrity against potential threats.

- User Experience Testing: Assess the user experience through usability testing, ensuring that the mobile payment system is intuitive, user-friendly, and provides a seamless transaction journey for users.

- Compatibility Testing: Test the mobile payment system across various devices, operating systems, and browsers to ensure compatibility. This step guarantees a consistent and reliable experience for users across different platforms.

- Performance Testing: Evaluate the performance of the mobile payment system under various conditions, such as peak loads and network fluctuations. This ensures the system can handle high transaction volumes efficiently without compromising performance.

Testing and quality assurance are critical to refining the mobile payment system, ensuring it meets functional requirements and delivers a secure, user-friendly, high-performance solution.

Steps 7: Deployment and Maintenance

The final step in the development journey is the deployment and ongoing maintenance of the mobile payment system. This phase involves making the system accessible to users and implementing continuous improvement and support strategies.

Key Points:

- Deployment Planning: Develop a comprehensive deployment plan outlining the steps and timelines for releasing the mobile payment system to users. This includes considerations for a phased rollout, user communication, and training if necessary.

- User Training and Support: Provide training resources and support to users, ensuring a smooth transition to the new system. This step helps users adapt to the changes and maximizes the system's effectiveness.

- Monitoring and Analytics: Implement monitoring tools and analytics to track the performance and usage patterns of the deployed mobile payment system. This ongoing analysis provides insights for continuous improvement and optimization.

- Bug Fixes and Updates: Address post-deployment issues promptly by implementing bug fixes. Additionally, plan and roll out regular updates to enhance features, security, and overall system performance.

- User Feedback Integration: Continuously gather user feedback and integrate valuable insights into the system's evolution. This user-centric approach ensures the mobile payment system meets user needs and expectations.

Deployment and maintenance mark the culmination of the mobile payment system development journey. It involves not only making the system accessible to users but also implementing strategies for continuous improvement, support, and adaptation to evolving user requirements and technological landscapes.

Common Features of Building a Mobile Payment System

In the dynamic mobile payment system development landscape, crafting a robust platform requires tailoring features for administrators and users. These features enhance operational efficiency and provide a secure and user-friendly payment experience.

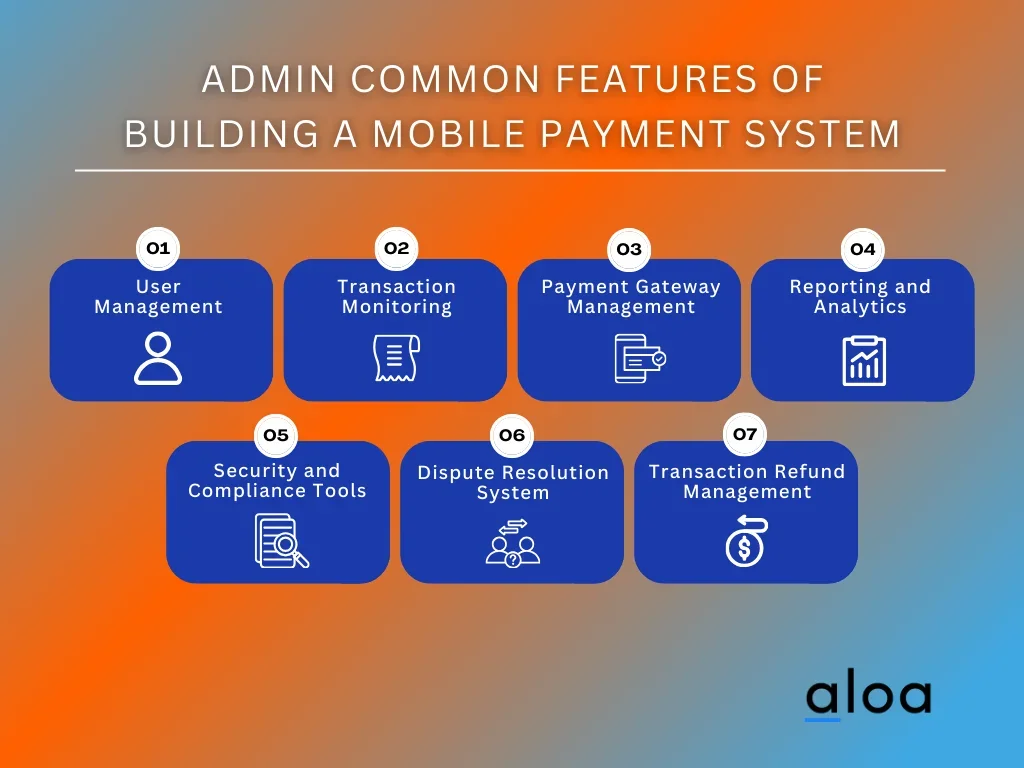

Features for Admin:

- User Management: Streamlined admin dashboard for efficient user account management, ensuring smooth oversight of permissions and access levels.

- Transaction Monitoring: Real-time tracking tools empower administrators to monitor transactions, bolstering security measures and providing detailed auditing capabilities.

- Payment Gateway Management: The seamless integration and management of diverse payment gateways facilitates efficient transaction processing for enhanced user experience.

- Reporting and Analytics: Comprehensive reporting tools deliver valuable insights into transaction trends, user behavior, and system performance, aiding informed decision-making.

- Security and Compliance Tools: Robust security features, including encryption and two-factor authentication, and tools to ensure compliance with industry regulations.

- Dispute Resolution System: A dedicated mechanism for administrators to handle and resolve disputes, fostering fairness and efficient conflict resolution.

- Transaction Refund Management: Tools for admins to manage and process transaction refunds, promoting transparency and accountability in financial transactions.

These meticulously designed features empower administrators with the tools they need, fostering operational excellence and ensuring a secure and compliant environment for the mobile payment system.

Features for User:

- Rewards and Loyalty Program: Integration of a rewards system incentivizes user engagement, offering benefits or discounts for frequent use and enhancing user loyalty.

- Budgeting and Spending Insights: Tools providing users with insights into spending patterns, budgeting recommendations, and financial planning assistance for informed money management. This includes a detailed analysis of credit card, debit card, and bank account transactions, helping users make informed financial decisions.

- User Registration and Profile: Streamlined registration processes and user profiles ensure a personalized experience and easy access to transaction history and payment information.

- Transaction History: Access to a detailed transaction history enables users to track and review past payments conveniently.

- Notifications and Alerts: Real-time notifications and alerts inform users about successful transactions, account updates, and security notifications.

- Security Measures: Implementing robust security features, such as biometric authentication and PIN codes, coupled with device authorization for heightened user account and transaction protection.

These features promise users a user-friendly and secure payment experience, convenience, and peace of mind in their financial transactions, fostering a seamless and trustworthy payment journey.

Benefits of Building a Mobile Payment System

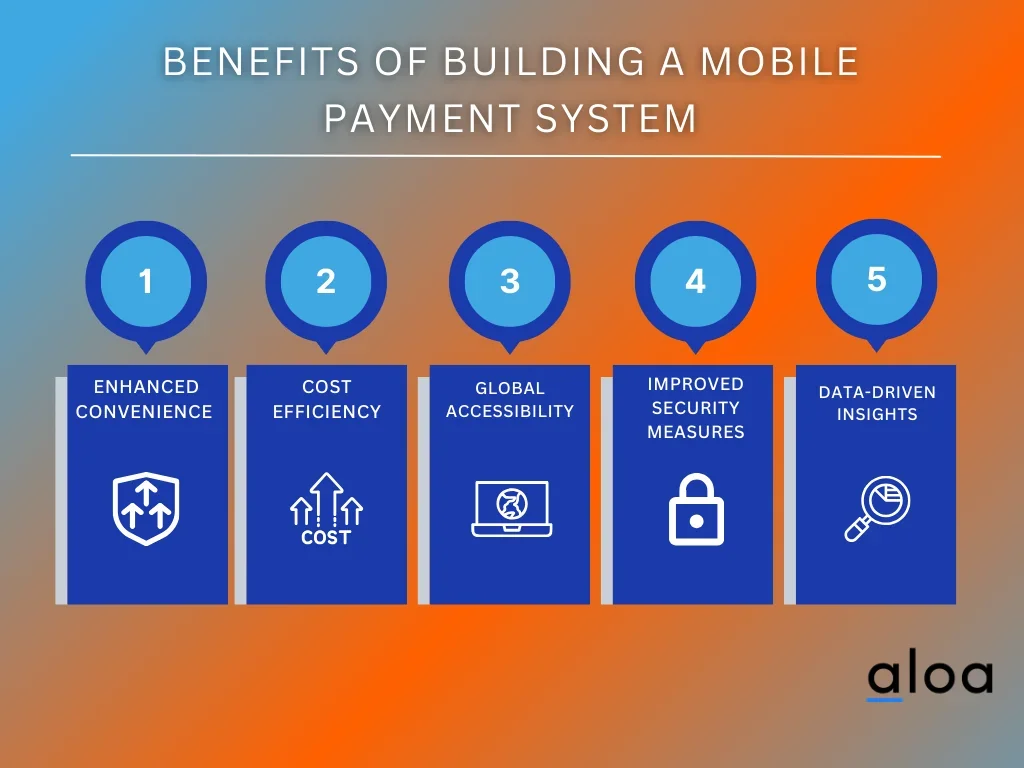

The development of mobile payment systems stands as a transformative force, offering many advantages to users and businesses. In this brief exploration, we delve into these benefits, showcasing how adopting mobile payment systems modernizes financial interactions and empowers businesses for sustained growth and success in the digital era.

Enhanced Convenience

By seamlessly transcending geographical constraints, mobile payment systems empower businesses to effortlessly conduct international transactions through iOS, Android, iPhone, and tablet devices. This expanded global accessibility facilitates mobile money transfers across borders and allows new avenues for companies to explore diverse markets beyond their immediate geographic reach.

This accessibility fosters a seamless connection between consumers and businesses, promoting financial interactions that align with the modern, on-the-go lifestyle.

Cost Efficiency

Developing a mobile payment system brings about substantial cost efficiencies for businesses. By streamlining checkout processes, organizations can reduce expenses associated with cash handling, manual reconciliation, and the logistical challenges of traditional payment methods.

This shift towards digital transactions saves time and resources and positions businesses to operate more efficiently in an increasingly digital marketplace, ultimately contributing to their financial health and competitiveness.

Global Accessibility

A mobile device cash app, leveraging the capabilities of near-field communication (NFC), breaks down geographical barriers, enabling big and small businesses to engage in international transactions effortlessly. This global accessibility, enhanced by near-field touch, opens up new avenues for expansion, allowing companies to tap into diverse markets beyond their immediate geographic reach.

It transforms the consumer and business landscape, fostering cross-border trade and creating global growth opportunities.

Improved Security Measures

One of the paramount benefits of a mobile payment system is its heightened security for financial transactions. These systems safeguard sensitive user data through robust security features such as encryption, biometric authentication, and real-time transaction monitoring, providing an extra layer of protection whether transactions involve email, mobile phone numbers, or other personal information.

This instills confidence and trust among users and safeguards against potential security threats, establishing a secure and reliable foundation for digital financial interactions.

Data-Driven Insights

Comprehensive reporting and analytics tools embedded in any mobile payment app give businesses valuable insights into transaction trends, user behavior, and overall system performance. This data-driven approach allows organizations to make informed decisions, adapt strategies based on user preferences, and enhance the overall user experience.

By leveraging these insights, businesses can refine their offerings, improve efficiency, and stay ahead in the rapidly evolving digital finance landscape.

Key Takeaway

Embracing the development of a mobile payment system, a pivotal and forward-thinking strategy, represents a significant leap towards fundamentally revolutionizing the landscape of internet-based financial transactions within the digital age. With the increasing use of smartphones and mobile apps for payments, businesses need to adapt and incorporate mobile payment services into their strategies.

At Aloa, we recognize the pivotal role of creating innovative and efficient mobile payment systems tailored to your unique business needs. With a team of skilled professionals proficient in mobile payment system development and leveraging the latest technologies, our commitment is to deliver exceptional solutions. We prioritize functionality, seamless integration, and the utilization of cutting-edge technologies to craft bespoke mobile payment systems that enhance your business operations.

Contact us at resources@aloa.co to explore how our diverse team of developers can elevate your mobile payment technology.