Managing international payroll can be complex and challenging, especially for startups venturing into global markets for the first time. It involves meticulously navigating diverse tax regulations, employment laws, and compensation structures that vary significantly across multiple countries and jurisdictions.

Ensuring timely and accurate payments, compliance with various regulations, and effectively sending international payments are all crucial aspects of successful international payroll management.

At Aloa, a software outsourcing firm specializing in global solutions, our connection to international payments stems from our extensive experience navigating diverse financial landscapes. Our expertly curated insights help startups streamline their international payroll processes and ensure smooth financial operations across borders.

This blog will explore essential tips and best practices to help startups navigate the intricacies of managing international payroll requirements for international workers. By the end, you’ll understand the key factors and strategies involved in effectively managing it for your startup’s global expansion.

Let’s dive in!

How to Manage International Payroll

Managing international payroll is crucial for companies operating across borders. The process can be complex, from navigating diverse tax regulations to ensuring compliance with local laws. However, with proper planning and the right strategies in place, companies can streamline and execute international payroll seamlessly.

Below are the steps to consider in managing international payrolls.

Step 1: Assess International Payroll Needs

Assessing international payroll needs involves evaluating the specific requirements and complexities of managing payroll across multiple countries or regions. This process ensures that payroll operations are tailored to meet each international location’s unique regulatory, cultural, and operational needs.

Here are ways how to assess international payroll needs:

- Evaluate Geographical Scope: Determine the countries or regions where employees and independent contractors are located to understand the scope of international payroll management.

- Review Legal and Tax Requirements: Research each international location’s labor laws, tax regulations, and reporting obligations to ensure compliance.

- Consider Local Currencies and Exchange Rates: Assess the impact of currency fluctuations and exchange rates on payroll calculations and payments.

- Evaluate Payroll Processing Complexity: Determine the complexity of payroll processing, including frequency of payments, types of compensation, and benefits offered.

- Assess Technology and Infrastructure: Evaluate the existing payroll systems and infrastructure for compatibility with international payroll software and features to determine their ability to support global payroll operations.

Step 2: Establish Tax Identification Numbers

Establishing tax identification numbers (TINs) is essential for international payroll management as they uniquely identify taxpayers and facilitate tax reporting and compliance. TINs are issued by tax authorities to individuals and businesses for the purpose of tracking tax obligations and ensuring accurate income reporting.

.webp)

Here’s how to obtain your tax identification numbers (TINs):

- Research the Specific Requirements: Different countries have varying procedures for obtaining TINs, so it’s crucial to research and understand the process specific to each jurisdiction.

- Gather Required Documentation: Typically, individuals may need to provide identification documents, residency status, and other relevant paperwork as per local regulations.

- Submit the Application: Complete the necessary forms and submit them to the appropriate tax authority with the required documentation.

- Follow up and Track Progress: Monitor the status of the TIN application and follow up with the tax authority if necessary to ensure timely issuance.

Step 3: Understand Tax Withholding Obligations

Understanding tax withholding obligations involves grasping the legal requirements of withholding taxes from employee wages to meet tax obligations. This ensures that the correct amount of payroll taxes is withheld from global talent paychecks and remitted to the appropriate tax authorities.

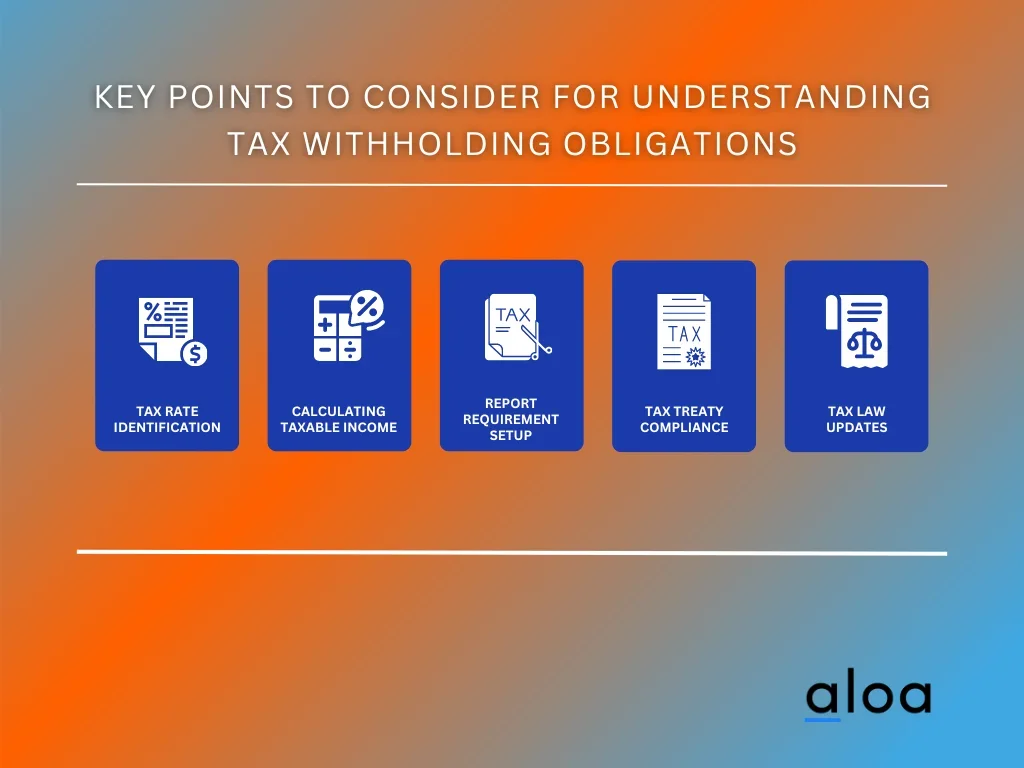

Understanding tax withholding obligations includes:

- Identifying Applicable Tax Rates: Determine the applicable tax rates for income taxes, social security contributions, and other statutory deductions in each international location.

- Calculating Taxable Income: Calculate the taxable income for employees based on their earnings, deductions, and exemptions according to local tax laws.

- Establishing Reporting Requirements: Understand the reporting obligations for withholding taxes, including the frequency and format of tax filings required by local tax authorities.

- Ensuring Compliance with Tax Treaties: Determine if any tax treaties or agreements between countries affect tax withholding obligations for international employees.

- Staying Updated on Tax Laws: Keep abreast of changes in tax laws and regulations in each international location to ensure ongoing compliance with tax withholding obligations.

Step 4: Determine Payment Methods

Determining payment methods for international payroll involves deciding how international contractors will receive their wages and benefits. This decision is crucial as it impacts the efficiency, convenience, and cost-effectiveness of payroll processes. As cross-border payment fees average 7.4% of the total transaction, it is are best you choose a method that is most advantageous to you. Optimizing your international payments strategy can help reduce these fees and ensure contractors are paid on time.

Below are the different payment methods to consider:

- Direct Deposit: Transfer funds directly into employees’ bank accounts, ensuring quick and secure payments without needing physical checks.

- International Wire Transfers: Send payments electronically to employees’ bank accounts abroad, accommodating global workforce needs.

- Prepaid Debit Cards: Issue prepaid cards that employees can use to access their funds conveniently, especially in regions with limited banking access.

- Digital Wallets: Utilize digital payment platforms for seamless and instant fund transfers, offering flexibility and convenience for international employees.

Step 5: Calculate and Distribute Payroll

Calculating and distributing payroll data for international employees involves a systematic process to ensure accurate and timely payments. This includes gathering employee time, managing pay stubs, considering the number of employees, and addressing employers of record responsibilities.

Additionally, accounting for statutory deductions, tax payments, and employee benefits specific to each country or region is essential. Once payroll calculations are completed, employee payments must be disbursed through appropriate channels, considering factors like currency conversion and local banking regulations.

Ensuring precision in payroll calculation and distribution is vital to upholding employee trust, regulatory compliance with legal requirements, and the overall efficiency of international payroll management.

Step 6: Maintain Accurate Records

Maintaining accurate records in international payroll management involves consistently recording and organizing all relevant financial data related to employee compensation and tax obligations. This ensures compliance with local regulations, facilitates accurate reporting, and minimizes the risk of errors or discrepancies in payroll processing.

Maintaining accurate records includes the following key points:

- Record Keeping: Keep detailed records of employee data, including personal details, employment contracts, and tax documents, to ensure comprehensive documentation.

- Payroll Calculations: Document all calculations related to employee wages, taxes, and deductions, providing a clear audit trail for payroll processing.

- Tax Reporting: Maintain records of tax filings, payments, and reports submitted to local tax authorities to demonstrate compliance with tax obligations.

- Communication: Document all communication related to payroll matters, including correspondence with employees, tax authorities, and payroll service providers, to ensure transparency and accountability in payroll management.

Step 7: Ensure IRS Compliance

This step involves staying up-to-date with IRS regulations and requirements related to international payroll operations. This includes partnering with a professional employer organization for expert guidance and support in benefits administration. Employers must accurately report employee wages, benefits, and taxes to the IRS, including those earned by employees working abroad.

Moreover, compliance with IRS regulations extends to tax withholding, reporting, and filing obligations for international employees. Maintaining meticulous records and adhering to IRS guidelines ensures smooth operations and reduces the risk of non-compliance issues.

Common Challenges of Global Payroll Management

In setting up global payroll management, startups often encounter various challenges that can impede smooth operations. Here are the common challenges startups face in managing international payroll, along with tips on overcoming them and ensuring smooth operations:

1. Diverse International Tax Codes

Navigating diverse international tax codes presents a significant challenge in global payroll management. These tax codes vary significantly across countries, requiring thorough understanding and compliance to avoid legal and financial risks.

Addressing this challenge involves staying abreast of changing tax regulations, leveraging expert advice, and implementing robust payroll systems that adapt to different tax regimes.

2. International Compliance Issues

Navigating international compliance issues in global payroll management involves addressing diverse regulations, including tax codes, labor laws, and data protection requirements. Compliance requires meticulous attention to detail, regular monitoring of regulatory changes across multiple jurisdictions, and collaboration with legal experts to ensure adherence to international standards.

Overcoming these challenges is vital to mitigate risks, avoid penalties, and maintain global trust with employees, regulatory authorities, and stakeholders involved in global hiring.

3. Legal Regulations Compliance

Ensuring compliance with legal regulations in international payroll management involves various aspects, including HR employee management services. HR plays a crucial role in updating labor laws, tax regulations, and employment standards in various countries to ensure accurate and lawful payroll processing.

Keeping your organization’s compliance with legal requirements helps mitigate risks, avoid penalties, and uphold organizational integrity across international operations.

4. International Data Security Measures

Ensuring international payroll data security is a critical challenge in global payroll management. Businesses and startups must secure sensitive employee information across multiple jurisdictions to safeguard data privacy and prevent unauthorized access or data breaches.

Overall, implementing comprehensive data encryption protocols, adhering to international data protection regulations such as GDPR, and regularly auditing security measures are keys to mitigating risks associated with international data handling in payroll management.

5. Technology Integration for Global Payrolls

Integrating technology for global payrolls involves navigating various complexities to ensure seamless operations and data management across multiple regions. This challenge requires compatible systems, scalable platforms, and efficient data synchronization to streamline payroll processes worldwide.

Additionally, utilizing best HR software can enhance efficiency in this endeavor. However, successful technology integration of this requires strategic planning, robust infrastructure, and ongoing optimization to meet the evolving needs of global payroll management.

6. Cultural Differences in International Payroll

Cultural differences in international payroll pose unique challenges related to communication, work practices, and employee expectations across various states. These differences require sensitivity, adaptability, cultural awareness, and guidance from local experts to effectively manage payroll operations and foster a positive work environment.

Addressing cultural nuances in workforce management involves tailored approaches, open dialogue, and cross-cultural training to ensure equitable and respectful payroll practices.

7. Language and Communication Barrier

Language and communication barriers are another significant challenge in global payroll management, particularly in multinational organizations with diverse workforce demographics. These barriers can lead to misunderstandings, errors in payroll processing, and delays in resolving payroll-related issues.

Overcoming language and communication barriers requires practical multilingual support, clear communication channels, and cultural sensitivity training to ensure accurate and timely payroll operations across different languages and cultures.

Top 3 International Payroll Management Solutions

A global payroll provider is essential for startups expanding their operations globally as they navigate various complexities. Below are the best global payroll service solutions that can help streamline processes.

1. Stripe - Offers Online and In Person Transactions

Stripe provides a robust financial infrastructure for the internet and enables millions of companies worldwide to accept payments, automate financial processes, and drive revenue growth. Stripe facilitates online and in-person transactions as a trusted international payroll service solution to empower enterprises and streamline their financial operations efficiently.

Stripe’s commitment to agility and scalability in global commerce sets it apart. Whether it’s supporting startups in launching their ventures or enabling enterprises to streamline workflows for maximum efficiency, Stripe offers expert integration guidance and user-friendly solutions that drive success.

Notable Features of Stripe

- Global Payment Handling: Stripe provides a comprehensive suite of financial and payment products to handle international payroll needs seamlessly

- Cost Reduction and Revenue Growth: Using Stripe, businesses can reduce costs associated with international payroll management, streamline operations, and grow revenue by leveraging efficient payment processing and financial management tools.

- Integrated Platform: Stripe offers an integrated platform for managing all payments-related needs, including payroll processing, revenue operations management, and launching new business models tailored to international markets.

- Comprehensive Payment Solutions: With Stripe, businesses can access various payment solutions, including global payment acceptance, currency conversion, fraud prevention, and custom in-person payment options.

Stripes Pricing Plans

Stripe provides pricing plans tailored to businesses of all sizes and offers flexibility and transparency for international payroll solutions.

- Standard: Businesses can access a comprehensive payments platform with straightforward, pay-as-you-go pricing under the Standard plan. This plan entails no setup fees, monthly fees, or hidden charges.

- Custom: Stripe offers a Custom plan for businesses with unique needs or larger payment volumes. This option allows businesses to tailor a package to precisely fit their requirements.

2. Braintree - Simplifies Payment Integration

Braintree is a leading global payroll software that empowers businesses to enhance revenue streams by reaching a broader audience and driving higher conversion rates. With a comprehensive payment platform offering PayPal, Venmo, credit, and debit cards, Braintree provides seamless integration for businesses.

Having a focus on delivering scalable solutions and white-glove support, Braintree offers businesses the opportunity to streamline operations and optimize revenue generation. This blend of innovative technology and extensive industry experience positions Braintree as a trusted partner for businesses looking to thrive in today’s competitive global marketplace.

Notable Features of Braintree

- Drive Conversion: Braintree helps drive conversion by reducing friction in payment processes, ensuring seamless transactions and boosting sales for internationally-operated businesses.

- Expand Your Reach: With Braintree, businesses can expand their reach and grow their market share globally by tapping into new markets and catering to customers worldwide.

- Increase Efficiency: Braintree streamlines business operations related to international payroll and provides efficient payment processing solutions that simplify cross-border transactions and improve overall operational efficiency.

- Help Mitigate Risk: Braintree offers advanced security measures to help mitigate risk, providing businesses with peace of mind when managing international payroll and ensuring the safety and security of financial transactions across borders.

Braintree Pricing Plans

Braintree offers transparent pricing for cards and digital wallets, with standard merchants charged at 2.59% + $0.49 per transaction. For verified charitable organizations, the rate is reduced to 1.99% + $0.49 per transaction, with additional fees for non-USD transactions and cards issued outside the United States.

Also, custom flat rates and interchange plus pricing are available for established businesses. At the same time, PayPal, Venmo, and ACH Direct Debit transactions are subject to specific fees and terms. For more tailored pricing options based on your business model and processing volume, contact Braintree’s sales team or customer service.

3. Dwolla - Provides Instant Payments Solution

Dwolla, a global payroll solution, offers a modern and streamlined approach to payment processing. Dwolla enables companies to eliminate outdated payment systems and manual processes, improving cash flow, payment predictability, security, and overall efficiency.

What sets Dwolla apart is its commitment to driving innovation and enabling businesses to unlock new payment possibilities. With a user-friendly API, competitive pricing, and a team of experts dedicated to providing exceptional service, Dwolla stands out as a trusted partner for businesses looking to automate and optimize their payment operations.

Notable Features of Dwolla

- Cost Savings: By leveraging Dwolla’s advanced payment technology, businesses can achieve significant cost savings through reduced labor costs, faster processing times, and lower transaction fees

- Seamless Bank Integration: Dwolla simplifies integrations across payment methods and financial institutions to facilitate seamless integration processes, ongoing maintenance, and future development.

- Customizable Solutions: Dwolla offers customizable HR tools tailored to the specific needs of businesses seeking to digitize their international payroll processes.

- Real-Time Payments: With Dwolla’s real-time payments feature, businesses can instantly conduct clear and settle transactions.

Dwolla Pricing Plans

Dwolla offers tailored payment solutions and pricing to meet the unique needs of businesses. With a focus on customization, their pricing is personalized to fit the specific requirements of each custom integration. Contact their payment experts or customer support to discuss your business goals and receive a personalized integration plan crafted to maximize the value of their solution.

Key Takeaway

Managing international payroll requirements presents a multifaceted challenge that demands careful consideration and proactive strategies. As large businesses and organizations expand globally, they encounter diverse legal, cultural, and operational complexities that impact payroll management.

A startup and small business that manages outsourced partnerships to global employees can greatly benefit from leveraging comprehensive payroll management solutions. Coupled with legal IRS compliance, fostering clear communication and having cross-functional collaboration are crucial for successful international payroll management.

Want to learn more about international payroll management? Aloa, a seasoned software outsourcing firm, offers invaluable support and guidance. Sign up now to join our community and gain exclusive access to our resources, insights, and best practices that will level up your international payroll management to high standards.